Payroll summary report tips for small business owners

- Payroll summary reports provide a detailed overview of your small business payroll activity, including wages, tax deductions, and more.

- If you don’t have a payroll provider to do this for you, there can be a lot to maintain and remember, especially for reports you need to submit to the government.

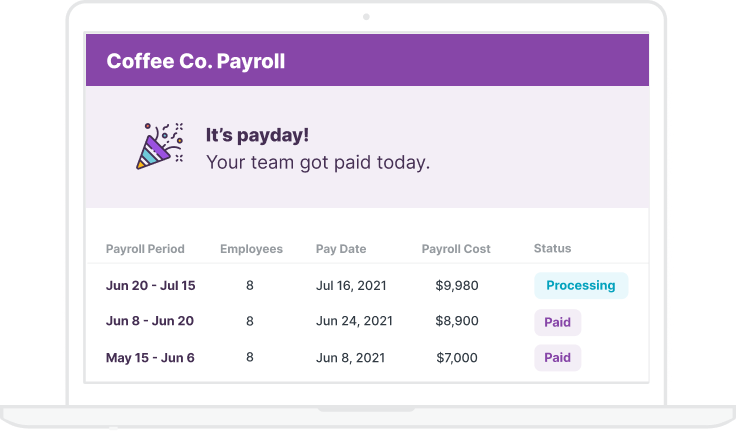

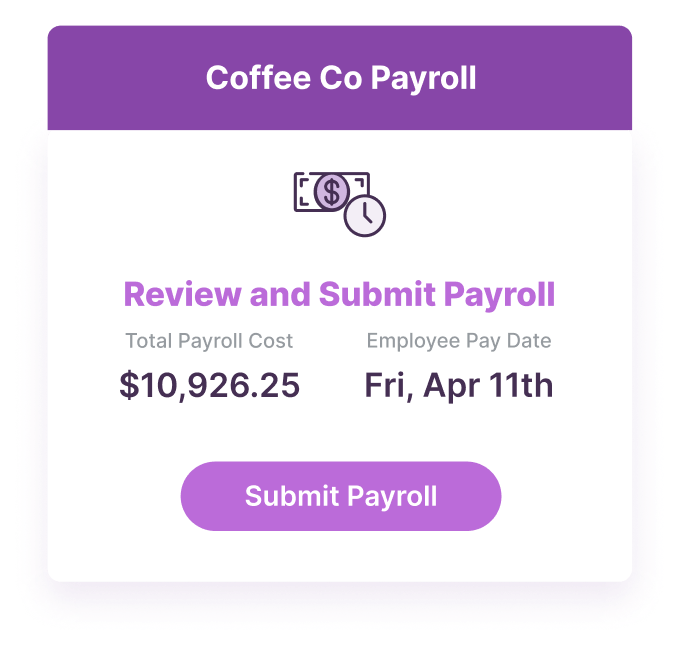

- Homebase is a full-service payroll provider that takes the headache away from your payroll process and keeps you compliant with state and federal laws at the same time.

What is a payroll summary report?

A payroll summary report, also known as a payroll activity summary report, shows an overview of your payroll activity, including employee details like:

- Gross pay: Gross pay is the amount of money an employee earns for hours worked for a specific date range before you subtract the appropriate amount of taxes or any other necessary deductions.

- Adjusted gross pay: This is the amount of money that is left for each employee after you subtract pre-tax deductions like a contribution to an employee’s 401(k).

- Net pay: Net pay is the money an employee actually receives after you take out taxes and any other deductions. This is the amount they will see on their payroll check or deposited into their bank account.

- Employer payroll taxes and contributions: This portion of your payroll summary report details the amount of money you paid in FICA and unemployment taxes, as well as any other tax liabilities you accrued like vacation time.

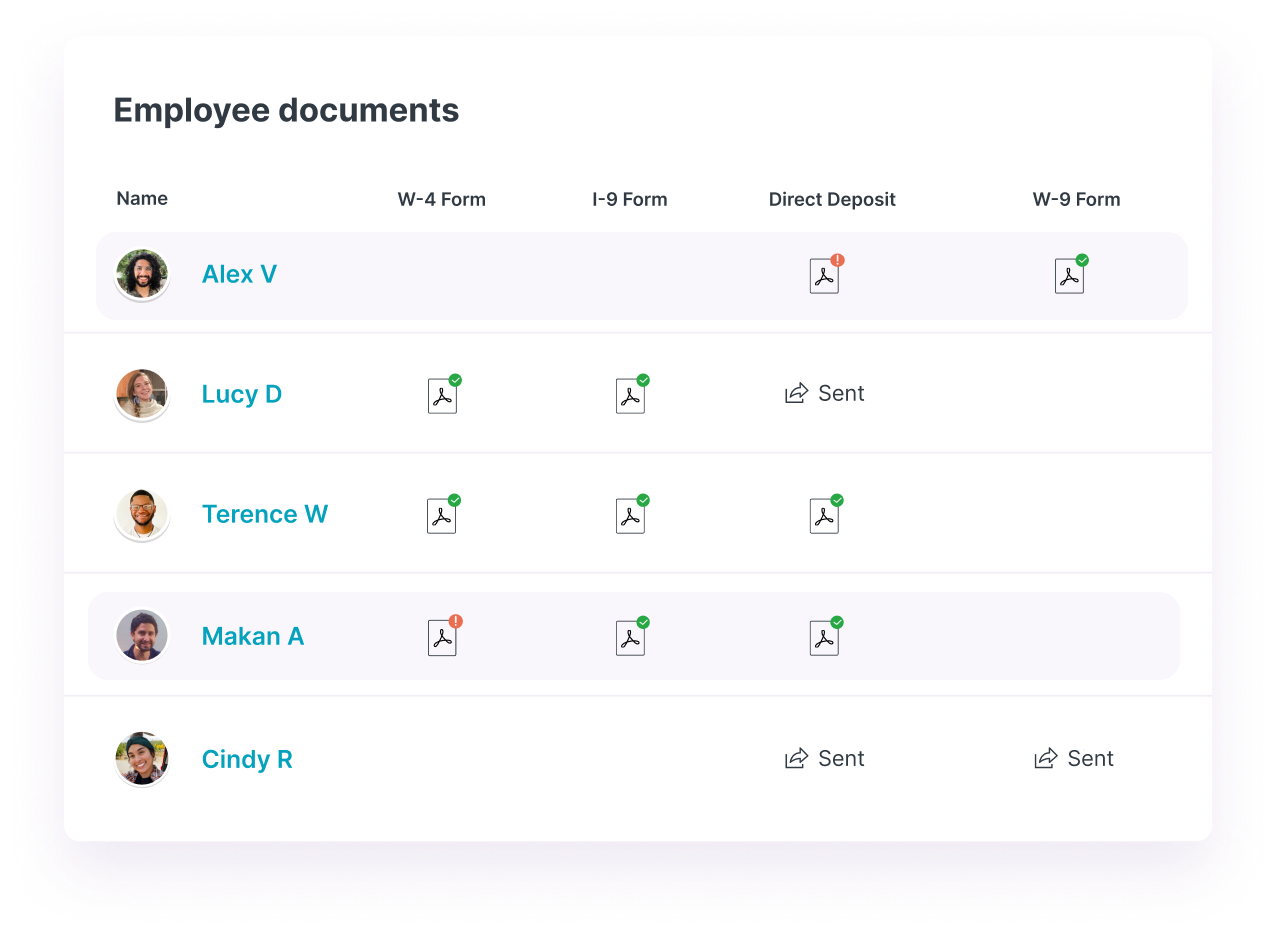

There are other payroll reports that list the year-to-date totals for both how much your employees earned and how much you contributed in taxes and other payments. According to the Fair Labor Standards Act, you must keep these records on file for at least 3 years.

If you don’t have a reliable way to maintain and properly store these documents, Homebase can help. We’ll store all the documents you need to remain compliant with federal and state labor laws. Get started today and see how easy it can be to keep up with important documents for each employee.

How do I write a payroll summary report?

If you do not have a payroll system to help you with payroll setup and need to write your payroll summary report in Excel or MS Word, you’ll need to collect the gross pay, adjusted gross pay, net income, and employer payroll taxes and contributions on your own.

However, if you use a payroll system like Quickbooks Payroll or any of the top payroll providers, you can easily set up your report without having to pull out your payroll calculator.

Many of the payroll systems available on the market today provide the same easy process for pulling a payroll summary report. First, look in the menu for a “reports” tab and click on it to continue to the next step. Then you will most likely see an option for “payroll summary.”

You can select a date range from a drop-down menu and also choose whether you want to run the report for one employee or multiple members of your team. The last step will most likely be to run the report, and your work is complete.

Barzotto

Marko Sotto

Owner at Barzotto

What kind of reports should a payroll specialist prepare?

While you can create any kind of payroll report you desire to gain insight on employee wages and spending, there are a few that are required by the government. You may be responsible for a local payroll report depending on where you live. If you’re just starting out with your new business, make sure to check your local employment laws to make sure you cover your bases.

There are also 43 states in the US that require income tax and unemployment tax payroll reports. The states that do not require these are Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

You are required by the federal government to submit several payroll report forms, including Form 941, Form 940, W-2, and W-3. If keeping up with all these forms seems too complicated, consider signing up for Homebase to make payroll submissions a breeze.

What is a payroll summary report example?

Here is an example of payroll summary report, also known as an employee payroll summary report sample:

Wages :

- Base salary: $3,000.00

- Hours: 160

- Vacation pay: $144.00

Taxes

- Income tax: $296.98

- UI – Employee contribution: $3,331.79, $297.50

- Total: $3,926.27

Expenses

- Vacation pay: $125.00

- Employer contribution: $296.98

- Expense for company car: $35.00

- UI – Employer contribution: $416.50

- Total: $873.48

Where can I find a payroll summary report template?

You can easily find a payroll summary report template Excel will accept here and here, but instead of worrying about payroll templates, it’s much easier to sign up for software that allows you to toss the paperwork and get the hard work done for you.

If you use Homebase as your online payroll provider, we’ll send your calculate hours worked, wages, and tips, and create the reports for you, allowing you to focus on other areas of your business.