Your online payroll service questions answered

- Online payroll services streamline your payroll process by taking on tedious tasks so you don’t have to worry about making errors.

- When you use a small business online payroll platform, you get the added benefit of sufficient security and great customer service to answer all your payroll questions.

- Homebase makes payroll even easier by automating the whole process for you.

What is online payroll software?

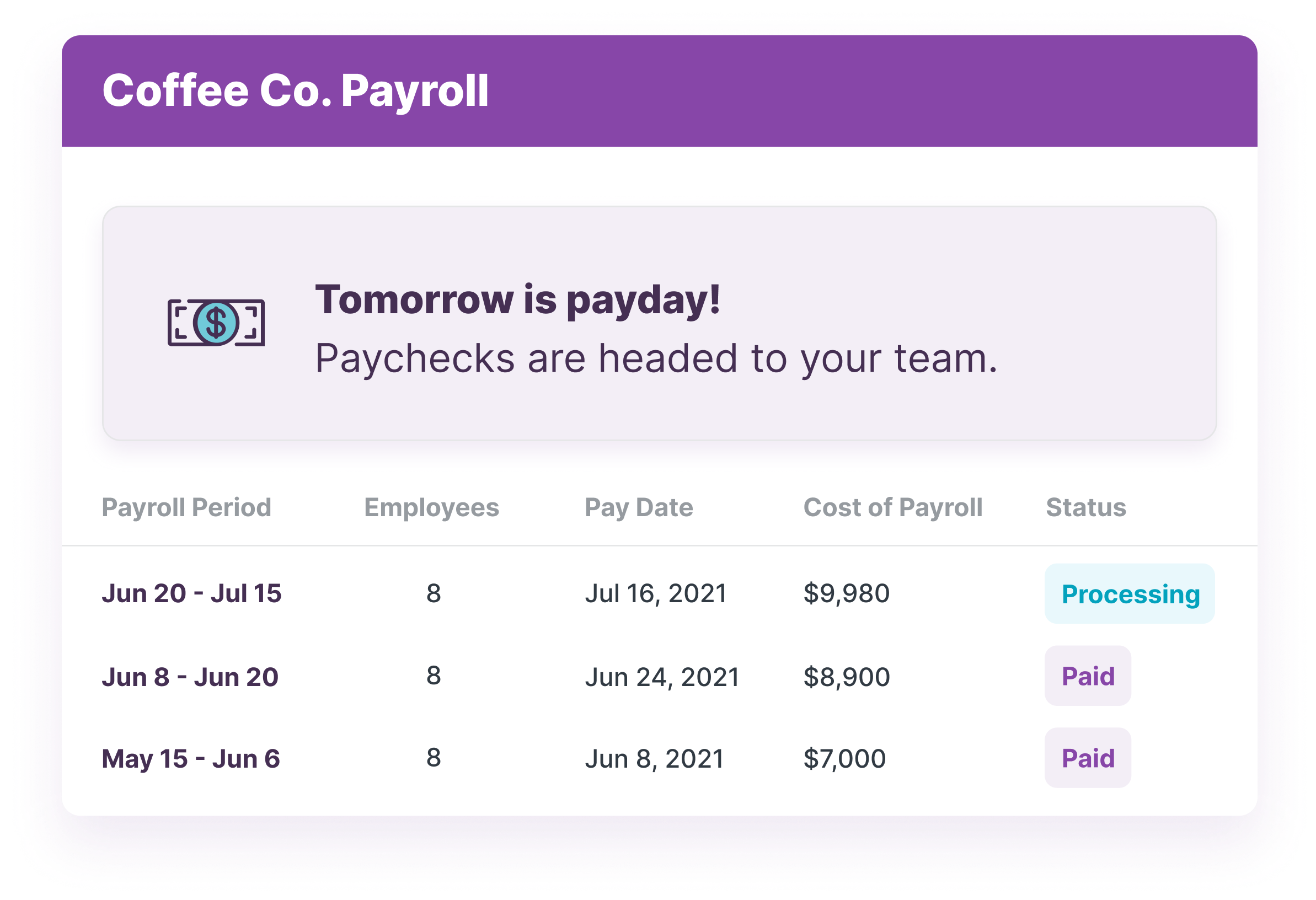

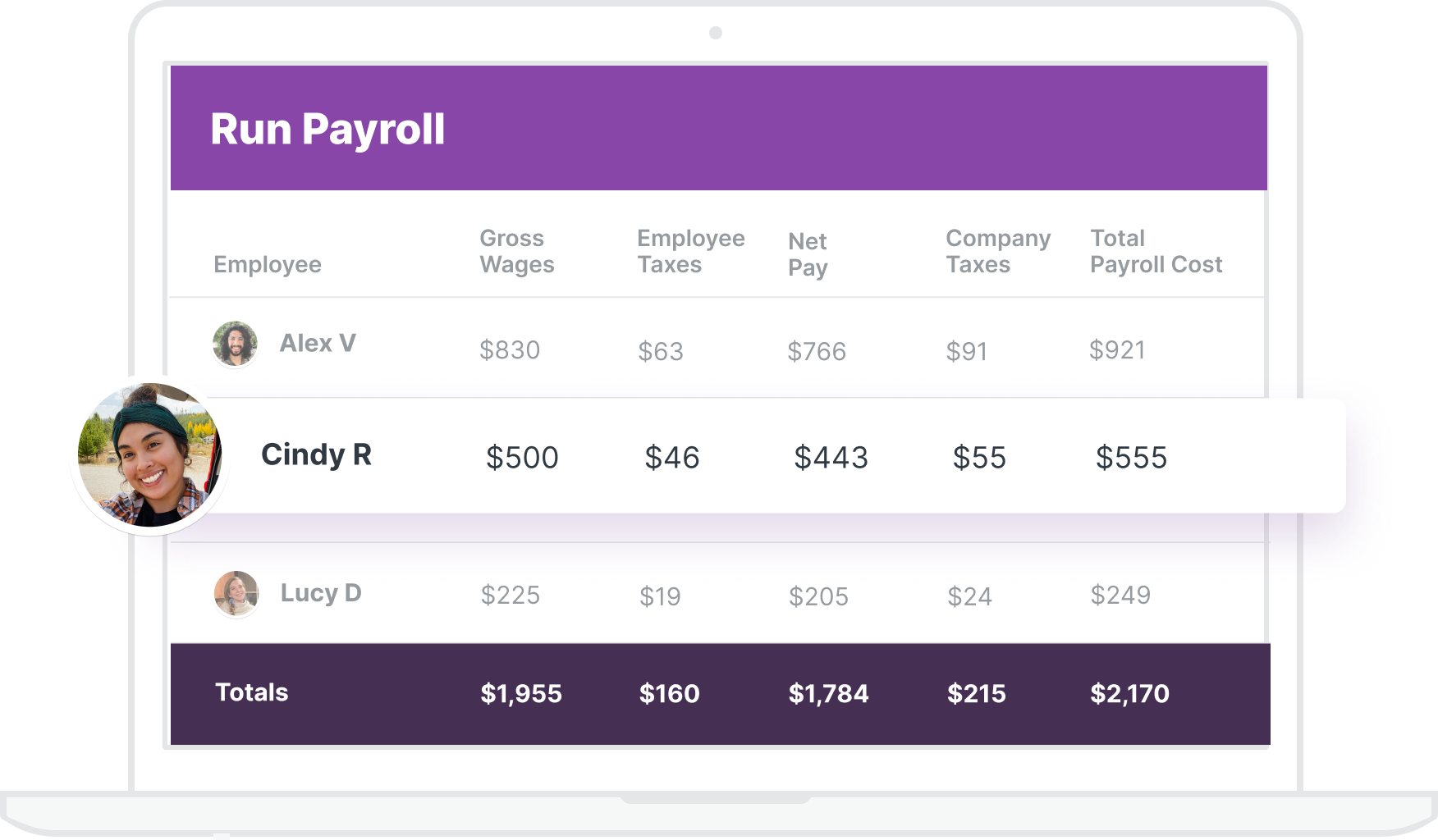

Online payroll systems are services that run payroll for your small business employees so you do not have to go through the tedious process of doing payroll yourself. When you use online payroll companies to outsource payroll, they handle the processing of payroll, direct deposit or check printing, payroll tax payments, and tax filing.

Online payroll services for small businesses take all the tasks and automate them on a cloud-based platform, meaning you’ll get a payroll online login code and you’ll be able to manage your payroll solution on a mobile app.

The software will also take into account employee benefits like health insurance so all your bases are covered.

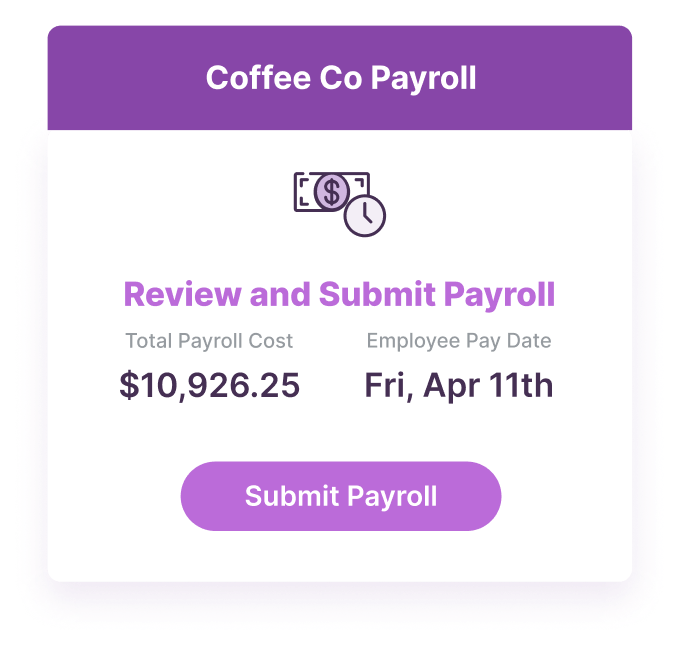

Homebase’s payroll solution automates your process, saving you hours each pay period.

What is the best online payroll service?

Your main priority should be to use a company with payroll offers that make your process efficient, accurate, and easy. The payroll services we integrate your Homebase account with pride themselves in providing top-notch services that automate your payroll process and make it simple and efficient.

Many top payroll providers also offer employee self-service features that allow your team members to keep track of their payroll information and more.

If you use a payroll service like Homebase, you won’t have to worry about combing through your timesheets and looking for any errors like overtime mistakes, clock-in errors, or time-tracking oversights that you may have missed if you were running payroll manually.

To find the best online payroll solution for your business, consider trying out a free trial to learn all you can about the features the service offers. It’s also important to find a service that has great customer service so you can trust them with your sensitive employee information.

To get a better feel for how they communicate with their customers, try giving them a call. This way you’ll learn about how the process works should you need help when using their platform.

Barzotto

Marko Sotto

Owner at Barzotto

Are there free online payroll software services?

There are several free payroll software solutions available online, but tread carefully. While you may think you are saving money by choosing a free platform, but using a less effective service with fewer features to benefit your process could cost you more in the long run.

For example, free payroll software solutions often come with minimal security compared to services you pay for. Your payroll software should be as secure as possible since the company you use will receive sensitive employee tax information. You could also miss out on customer support capabilities that make payroll easier for you.

Take serious consideration when choosing your online payroll service, because you do not want to get wrapped up in an audit by the IRS. If you do decide to go with a free payroll provider, you might have to be a little more diligent about your payroll calculations. Make sure you’re looking at every aspect of how you pay your employees or you could face large fines.

Your best bet is to use an online payroll service like Homebase that offers everything you need. And since Homebase also offers time tracking, scheduling, communication, and more, you’ll take your efficiency to the next level.

How do I do payroll online from home?

There are several ways to go about running payroll online for your small business from your home. Regardless of whether or not you want to use an online payroll service, make sure you have all the tax logistics covered, like registering your business with the IRS and obtaining an Employee Identification Number.

Then ensure that you have all the proper paperwork filled out for each team member that works for you. These forms include the W-4, which identifies the tax filing status and personal allowances they have determined for themselves.

Then you’ll need to calculate the taxes on both the federal and state levels, depending on where you live. You can use tools like the IRS Withholding Calculator as well as any resources provided by your state tax department to calculate the right tax amount. If you are manually running payroll, make sure you keep track of tax portions required from both you the business owner and your employee.

A payroll schedule is also necessary, you will need to obtain worker’s compensation insurance, and you will need to post notifications in the workplace displaying employee benefits and tax regulations. Make sure to also keep track of employee pay dates, tax payment deadlines, and filing due dates.

If you are not using an online payroll service, you will need to submit federal, state, and local taxes yourself. You will also need to submit your federal tax return on your own each quarter, as well as annual filings at the end of each year.

Instead of worrying about every tedious step in the payroll process on your own, it’s in your best interest to use an online payroll service to help you automate and streamline your payroll practices.

Consider using an online payroll service like Homebase to save the headache of staying compliant and ensuring every aspect of payroll is completed.

How much should small business online payroll cost?

There are several different pricing models that payroll providers use to charge small businesses for automated payroll. Regardless, the price is actually more affordable than some might think. Typically, there are 3 different models that payroll providers utilize when setting up payroll costs.

“Per frequency” is the first pricing model that online payroll services use. This means that you will be charged a base fee per employee, as well as a fee each time you run payroll. For example, if you process payroll weekly and have 10 employees, you will be charged 4 times for the month with an extra fee per employee tacked on.

Some payroll providers use “per employee, per month” to charge small businesses. These companies will provide an unlimited number of payroll runs a month, but will charge you monthly for each employee you run payroll for at a fixed rate. If your payroll schedule is slightly irregular or if you give out bonuses and other benefits, this might be the best pay strategy for you.

Many providers simply use a “fixed rate” model to charge their customers. The fixed rate means you get charged the same amount every month, no matter how many times you run payroll. But keep in mind that these companies may sometimes limit the number of employees you can run payroll for each month.