Giving employees bonuses can bring massive benefits to your business. You can thank people for doing great work and incentivize them to hit targets, which boosts engagement and productivity.

But it can be challenging to decide what type of bonus will work best for your team, as well as figure out which bonuses are mandatory and which are optional. It’s also crucial to know your tax obligations if you pay bonuses, which can feel intimidatingly complex to figure out alone.

That’s why in this post, we:

- Explain what bonus pay is and why you may want to award it

- List the different types of bonuses

- Discuss the two main bonus categories and how to calculate taxes for each

- Show examples of how to calculate taxes

- Outline the two main ways to handle payroll taxes (as well as one you should avoid!)

- Specify some bonus best practices to ensure you always have a good experience paying them

Once you know the key facts about bonus payroll and get the right tools in place to help you run it, you’ll be able to manage it quickly and easily. Then, you can get right back to rewarding your incredible employees in a meaningful way.

What is bonus pay?

Bonus pay is extra money you pay your employees on top of their regular earnings. For example, you can use them to:

- Thank team members for their contributions to your business

- Motivate people to consistently perform at their best

- Reward staff for exceptional work

When people talk about bonuses, their minds typically jump to those that come at the end of the year. But bonus pay is a flexible term that can refer to any extra amount of money that’s paid out at any time of the year.

Bonus pay can also be a recurring or one-off payment, and Homebase payroll lets you calculate both kinds.

It’s also important to recognize that, depending on the business and industry, bonuses can make up a substantial portion of your employees’ income. For example, in the US, the average bonus pay for hourly workers is around 5.6% of their salaries, which equates to over a month’s wages.

Why should you award work bonuses?

Bonus pay isn’t required by the Fair Labor Standards Act (FLSA). But many businesses pay it out because of the advantages it offers, including:

- Incentivizing employees to work efficiently and meet targets.

- Encouraging great customer service, which boosts five-star Google reviews and positive word-of-mouth recommendations.

- Helping staff become more emotionally invested in their work and enjoy it more. In fact, workers who get bonuses are 8x more engaged than those who don’t.

Well-managed bonuses show staff you appreciate and value them and their work. And happier employees are also more likely to show up on time, stick to their allotted breaks, and follow internal policies. They’ll probably want to stay at your business for longer, too, which reduces recruitment and training costs.

What are the different types of bonuses?

There are several different kinds of bonus payments, but here are some of the most popular ones:

- Holiday pay: A gift to celebrate special times of the year. For example, a Christmas or summer bonus.

- Stock options: Giving employees shares in your business.

- Sales commission: Paying employees a percentage of the sales they make.

- Signing bonus: A payment when a new hire accepts a role, usually after they’ve spent a certain amount of time in their position.

- Retention bonus: A reward for an employee who works for your business for a previously agreed-upon amount of time.

- End-of-year bonus: A yearly payment, also known as an annual bonus.

- Employee-to-customer referral bonus: A reward for an employee who recommends your business to someone, which results in a larger customer base and higher sales.

- Employee-to-employee referral bonus: A reward for an employee who encourages someone to apply for work at your business, which leads to them getting hired.

- Spot bonus: A one-off bonus you give to an employee for a specific achievement. For example, introducing a popular new product to your store.

- Performance (reward-based) bonus: An extra payment to thank employees for excellent performance and hard work.

- Performance (goal-based) bonus: An extra payment when specific individuals or your whole team meet previously agreed upon objectives.

The two bonus categories (and how to calculate bonus pay)

Bonus pay falls into two categories: discretionary and nondiscretionary.

Discretionary bonuses

Just like they sound, you make discretionary bonuses at your own discretion. They’re not in employee contracts and are completely optional.

Some examples include:

- Cash gifts for the holidays

- On-the-spot, one-off bonuses for exceptional work

- Rewards-based performance bonuses

So, how do you calculate what to pay each employee? Some businesses decide on a bonus budget and simply divide it by the number of team members they have. But this isn’t always fair, especially if individuals work different hours.

A fairer method is to:

- Add up your team’s total hours

- Divide your bonus by that total

- Multiply the number you get by each employee’s number of working hours

|

As a bonus pay example, let’s say you have a small cafe. You have three full-time employees and two part-time employees, so five in total. Your full-time staff each work 35 hours a week. Your part-time staff each work ten hours a week. Your bonus budget is $5000 in total. So to keep your bonus payments fair, you’d calculate:

So, you’d give your full-time workers $1400 each and your part-time workers $400 each. This is a more accurate reflection of each employee’s contribution to your business and is much less likely to cause resentment than if you simply divided $5000 by five. |

Nondiscretionary bonuses

Nondiscretionary bonuses are the opposite of discretionary bonuses. They’re clearly stated in employee contracts and aren’t optional.

They may include:

- End-of-year bonuses

- Signing bonuses

- Referral bonuses

- Sales commissions

- Goal-based performance bonuses

You have a legal obligation to pay nondiscretionary bonuses if the employee meets the stipulated conditions. However, you can write conditions into your work contracts to protect your business from staff abusing the bonus system.

For example, you might indicate that new hires must work for your business for a minimum of six months before you pay them a referral bonus. That means you won’t have to pay for new team members that perform badly or leave quickly.

In addition, calculating nondiscretionary bonuses isn’t the same as calculating discretionary bonuses. You need to use other formulas.

For one-off nondiscretionary bonuses, you might decide on a suitable amount for the situation, your business size, and your industry. For example, salons might pay $1000 for each employee referral that stays around for at least six months.

For recurring nondiscretionary bonuses based on employee tenure, role, and performance, you have to get each individual’s data for every criterion and multiply their average monthly salary by those numbers.

Let’s see how this calculation works in action.

|

For example, you have a supervisor who has worked at your cafe for four years. They made $25 000 in sales over the past year and earn $2500 per month. So, with the formula above, you’d use:

So, the supervisor’s bonus would come to $3630. |

You could make it easier by calculating each bonus based on the same percentages. But you likely want to reward more experienced and higher-performing employees. So it makes sense to allocate different percentages to different employees.

This is a fairer strategy. It also incentivizes staff to improve their skills and keep working for you because they know experience and great performance are rewarded.

The Homebase platform makes it easier to calculate additional pay by automating payroll and timesheets and figuring out your discretionary and nondiscretionary bonuses.

This saves you hours of time and stress compared to manual calculations.

3 ways to handle bonus payroll taxes

There’s no legal way to pay employees bonuses without taxes. And you have three options for taxing and processing bonus payments:

- Run separate bonus payroll (“the percentage method”)

- Include the bonus in your regular payroll run and denote it (“the aggregate method”)

- Include the bonus in your regular payroll but don’t denote it (not recommended)

1. Run separate bonus payroll (“the percentage method”)

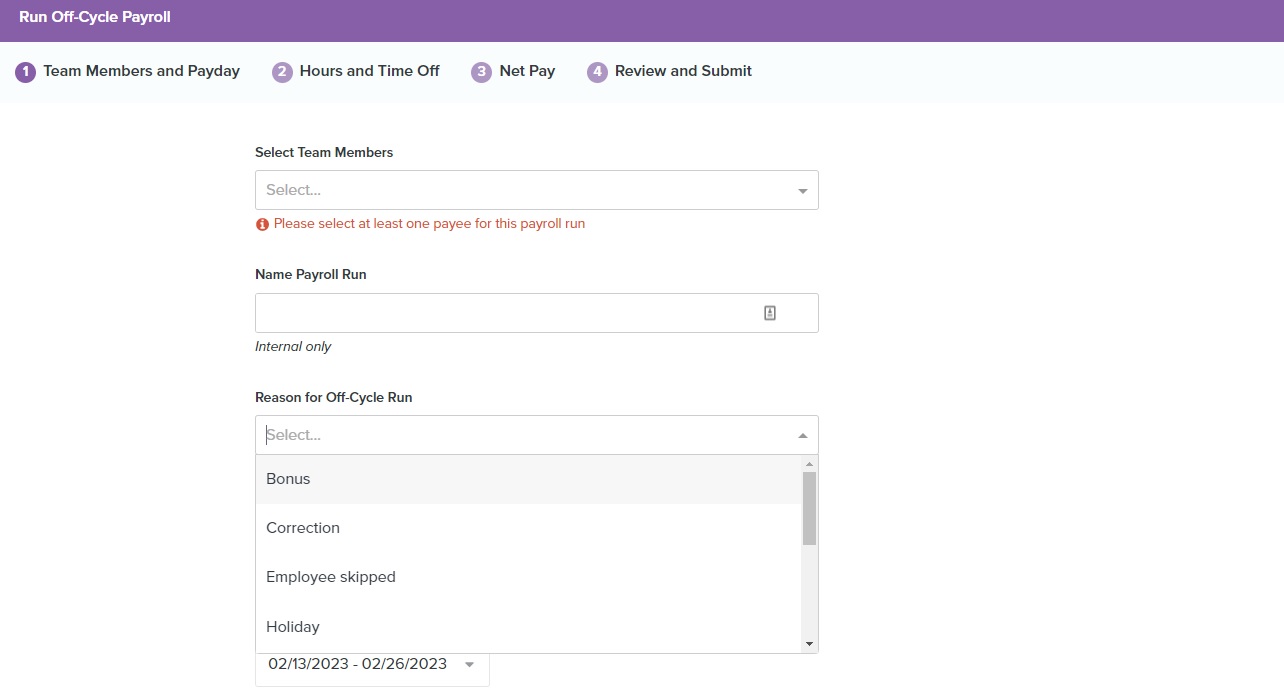

Caption: Homebase payroll makes it easy to run separate payroll. Just select the team members you want to include and select the reason for the off-cycle payroll (for example, a bonus).

If you run separate bonus payroll (as opposed to your regular payroll), employees will get their bonuses on a separate check.

You’ll have to withhold income tax at a rate of 22% — the flat withholding rate for all supplemental pay under $1 million in the United States. The bonus will also be subject to other regular payroll taxes.

Advantages

- Easy to calculate as a flat percentage, so less error-prone. And if you’re using Homebase payroll to calculate and send tax payments, you’ll spend very little time on the process.

- Employees may prefer it. If they’re in a tax bracket equal to or higher than 22%, they’ll pay less tax.

Disadvantages

- Some employees may not like it. If a worker is in a lower tax bracket, this method could result in over-withholding.

In the above situation, the team member can claim the money back, but they’d probably prefer to avoid the paperwork. Also, getting a bonus now rather than later could make a big difference to their finances.

That’s one of the reasons why the best way to pay employee bonuses is through the aggregate method.

Homebase lets you run separate payroll easily:

- In your Payroll dashboard, click Payroll Runs on the left dashboard.

- Under Payroll Actions to the right of the screen, click Run off-cycle payroll.

- This screen (pictured above) is where you choose which team members to include and the reason for the payroll (like bonuses).

- You can then select the pay period and payday and choose whether you want to enter hours manually or import time cards.

- You can then add time off, other earnings, and tips.

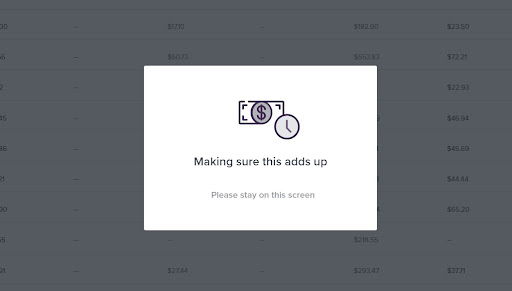

- Hit Next to review and submit the run. Homebase will make sure that everything adds up correctly for you.

2. Include a bonus in your regular payroll run (“the aggregate method”)

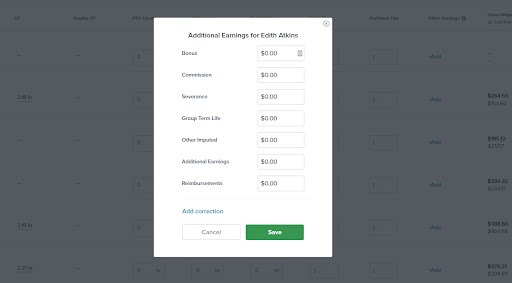

Caption: Homebase payroll lets you add additional earnings when you run payroll by clicking on each team member.

When using the aggregate method of withholding, bonuses should be paid through payroll. That means including them alongside your employees’ regular wages but indicating them clearly.

This method is more complicated but still manageable, especially if you have support from your payroll provider or use Homebase payroll.

To calculate your taxes with the aggregate method, take the following steps:

- Calculate the income tax you need to withhold on the regular pay and bonus combined.

- Calculate the amount you need to withhold on your employee’s regular wages.

- Subtract (2) from (1) to get the total tax you must withhold from the bonus.

|

Imagine you have an employee whose annual salary is $12 500, so around $1400 per month. That puts them in the 12% tax band. One month, you give them a bonus of $500. You’d have to calculate:

So, you’d withhold $60 from that employee’s bonus pay. |

Homebase lets you run this kind of payroll easily:

- In your Payroll dashboard, click Payroll Runs on the left dashboard.

- Click the green button near the top of the screen that reads Run Payroll or Resume Payroll.

- On the page that appears, you’ll see a list of your team members.

- For each team member, you have the option to click +Add under the Other Earnings column.

- For each team member you want to add a bonus for, hit +Add and enter the dollar amount in the Bonus box.

- Hit Save or the Enter key.

- The bonus amount will show up in the Other Earnings column for each team member.

- Hit Next and Homebase will take care of and check all the calculations.

Caption: Homebase will automatically check that your payroll adds up and makes sense.

3. Lump the bonus in with regular wages (not recommended)

Technically, there’s a third option. You could increase your employees’ regular wages and not indicate their bonus. That means you’d withhold taxes on their combined wages and bonus pay as though it was all regular pay.

This might seem like an easier option, but it could cause problems for your business and staff, and we don’t recommend it.

The Internal Revenue Service (IRS) usually treats bonuses as “supplemental wages,” which is why they’re subject to a supplemental withholding rate. So if you fail to report your employees’ supplementary pay, it leads to incorrect tax withholding.

That means extra paperwork and stress for you and your employee when you have to fix the mistake later. Even worse, it may damage your team’s trust in you.

4 other ways to pay out bonuses

There are more ways to pay out bonuses or employee incentives than a simple check.

Cash

Another way to pay bonuses is to give them in cash. This is a more immediate way of literally handing money to your staff and showing them your appreciation. It may also feel more tangible because employees can actually see and feel the money.

However, when you pay bonuses this way, they’ll still be subject to the same tax rules as when you do it with an electronic payroll process. So, cash bonuses can end up being a hassle for both employees and employers.

Stock options

Offering employee stock options (ESOs) means giving team members shares in your business. Staff are able to buy shares at a set price rather than the (usually higher) market rate. That means if they sell their shares later, they’ll very likely make money.

If your company is doing well, offering ESOs is a good form of compensation. It can also incentivize staff to stay longer as they may want to wait until their ESOs mature or the share price rises before selling.

Giving more shares the longer an employee stays with the company can also boost retention.

Gift cards

Gift cards reward employees with a voucher for a specific brand or product type. They may be more personal and can even send a powerful message.

For example, if you give employees a gift card for a wellness day or a massage at a local spa, you’re encouraging them to take a break, which could be a very welcome surprise.

However, this option may be risky because:

- It may be difficult to know what to get an employee, especially if you don’t know them well.

- Some staff, especially if they’re struggling financially, may prefer money to a gift card so they have more choice of what to spend it on.

- It may increase employee frustration if the gift card is for a brand or item they don’t like or won’t use.

- Bonuses are typically worth more than gift cards (for example, $1000 vs. $100). As a result, gift cards might seem tokenistic to some employees.

However, gift cards may be a great option for your business if you can’t afford to give sizable bonuses but still want to show your appreciation. They may also work well for smaller businesses where managers know their employees better.

Gifts

Offering team members gifts is another option. However, they carry a lot of the same risks as gift cards.

Giving gifts in a business setting may also blur boundaries between personal and professional relationships and create a sense of indebtedness. In extreme cases, it may also put you on the wrong side of bribery laws, especially if the gift is of high value.

Gifts also shouldn’t be confused with regular supplies that employees need and should be given anyway. That might include a computer, technical support, safety equipment, or a car fuel allowance.

However, when chosen carefully, gifts can be a nice touch. Some ideas are:

- A bottle of wine during the holiday season (or a non-alcoholic option)

- Pizzas for the whole team on Friday lunchtimes (including options for special dietary needs)

- A group meal paid for by management to celebrate a productive quarter

- A high-value watch to thank an employee for their many years of service

Bonus pay best practices

When giving bonuses, it’s important to bear the following in mind.

Ensure fairness and transparency

Bonuses should be a source of happiness for employees, but they can easily turn into a contentious issue if they’re not handled carefully.

Above all, prioritize fairness and transparency. That means:

- Offering bonuses that are clearly linked to measurable factors like performance, sales targets, or hours worked.

- Calculating bonuses the same way for all employees.

- Being transparent about how you calculate and pay your bonuses.

- Keeping accurate records for tax purposes.

Understand how to handle disputes

Whenever you pay out money, it’s important to be prepared for disputes or issues. For example, if you discover an employee didn’t actually qualify for what they received. Or, maybe someone felt short-changed and wants to challenge you on it.

Ways to avoid and handle issues include:

- Stating your policy for resolving future possible bonus pay issues in your contracts

- Checking the legal rules or requirements that apply to your business

- Always explaining your thought process and actions clearly and fairly

For example, you may not be able to request that an employee pay back their bonus (or deduct it from their future paychecks) unless that possibility is stated upfront in their contract.

You may also not be able to avoid paying nondiscretionary bonuses if they’re stated in an employee contract. Nor can you dismiss someone to avoid paying bonuses. Doing so may give the staff member cause to sue you for wrongful termination.

You should also state very clearly which bonuses are discretionary and which are not, as well as the exact requirements needed for a pay out, as this can avoid ambiguities in the future.

Know the legal and tax implications

However you choose to pay bonuses, it’s important to be aware of the tax implications. As we mentioned above, the IRS typically sees bonuses as “supplemental” to ordinary wages or pay.

That means they get taxed at a flat rate of 22% (no matter the tax rate of the employee). Most types of bonuses are subject to this rate. That includes gifts, tips, cash payouts, overtime, and some commissions.

As an employer, it’s your responsibility to calculate taxes accurately and send the correct portion to the IRS, also known as tax withholding. We covered the two main ways of calculating how much you need to withhold in the section above: the percentage method and the aggregate method.

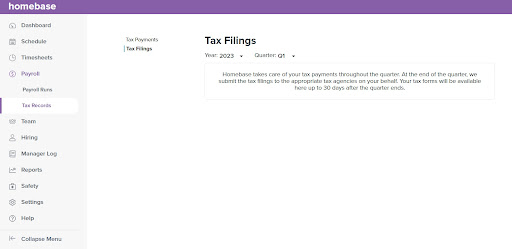

But using a platform like Homebase makes calculating accurate taxes much easier and reduces both stress levels and the time you have to spend on manual math too:

- To access the tax section, click Payroll on the left dashboard.

- Hit Tax Records.

- Select either Tax Payments or Tax Filings to see your most recent activity.

Caption: Homebase has a dedicated section within its dashboard designed to help you manage tax payments and tax filings.

Make bonus pay a celebration, not a stressful disaster

Who doesn’t want to reward their employees for their hard work? It leads to improved productivity and increased staff loyalty and longevity, after all.

But you want to make sure you pay bonuses without punishing yourself with hours of manual calculations, stressful tax paperwork, or unhappy employees.

If you’re looking to take the hassle out of your payroll process, Homebase payroll can help.

Our platform can handle all your payments, calculations, paperwork, and bonus tax rates for you. And when you sign up, you can onboard employees, track their time, and run payroll all in one place.

Bonus payroll FAQs

Are holiday bonuses taxed?

Yes, holiday bonuses are taxed as they’re considered a kind of compensation. However, they’re taxed at a different rate than regular pay, so you need to process them differently.

How are year-end bonuses taxed?

If you include a year-end bonus as part of a standard payroll check, you should treat it the same as regular taxable income. If you choose to include year-end bonuses on separate checks, they’ll be taxed at a flat rate of 22%.

What is the difference between overtime pay and a bonus?

Overtime pay is a nondiscretionary bonus. It’s mandatory to pay, and employees are entitled to it based on the number of overtime hours they clocked in during a workweek. On the other hand, many bonuses are discretionary, meaning they’re optional. They’re offered as an incentive for exceptional employee performance.

Is a bonus better than a pay raise?

From a business perspective, yes, bonuses may be more beneficial than pay raises in some cases. Bonuses are variable as they’re often based on employee performance or specific results. That means, unlike pay raises, you can reduce them if your budget decreases.

Are there disadvantages to handing out bonus payments?

Yes, there are some disadvantages to handing out bonus payments. Once you’ve introduced bonuses, employees may expect them even if you don’t have the budget for them. This may lead to lower morale and staff feeling disappointed if you can’t deliver.